Skill

Run depreciation

With that skill, you can create a fixed asset, define the depreciation method, assign it to an employee or class or department, define the life cycle so Hala can post the depreciation directly in QuickBooks Online by making a Journal Entry document.

Description

The Skill of creating a new fixed asset is part of the asset management skills package.

With that skill, you can create a fixed asset, define the depreciation method, assign it to an employee or class or department, define the life cycle so Hala can post the depreciation directly in QuickBooks Online by making a Journal Entry document.

You would also need to define the balance account, depreciation account, and write-off account to enable Hala to make JE posting in QuickBooks Online.

How to start use the skill

As an example, you can use the next utterances to execute this skill:

Run the depreciation

Start depreciation

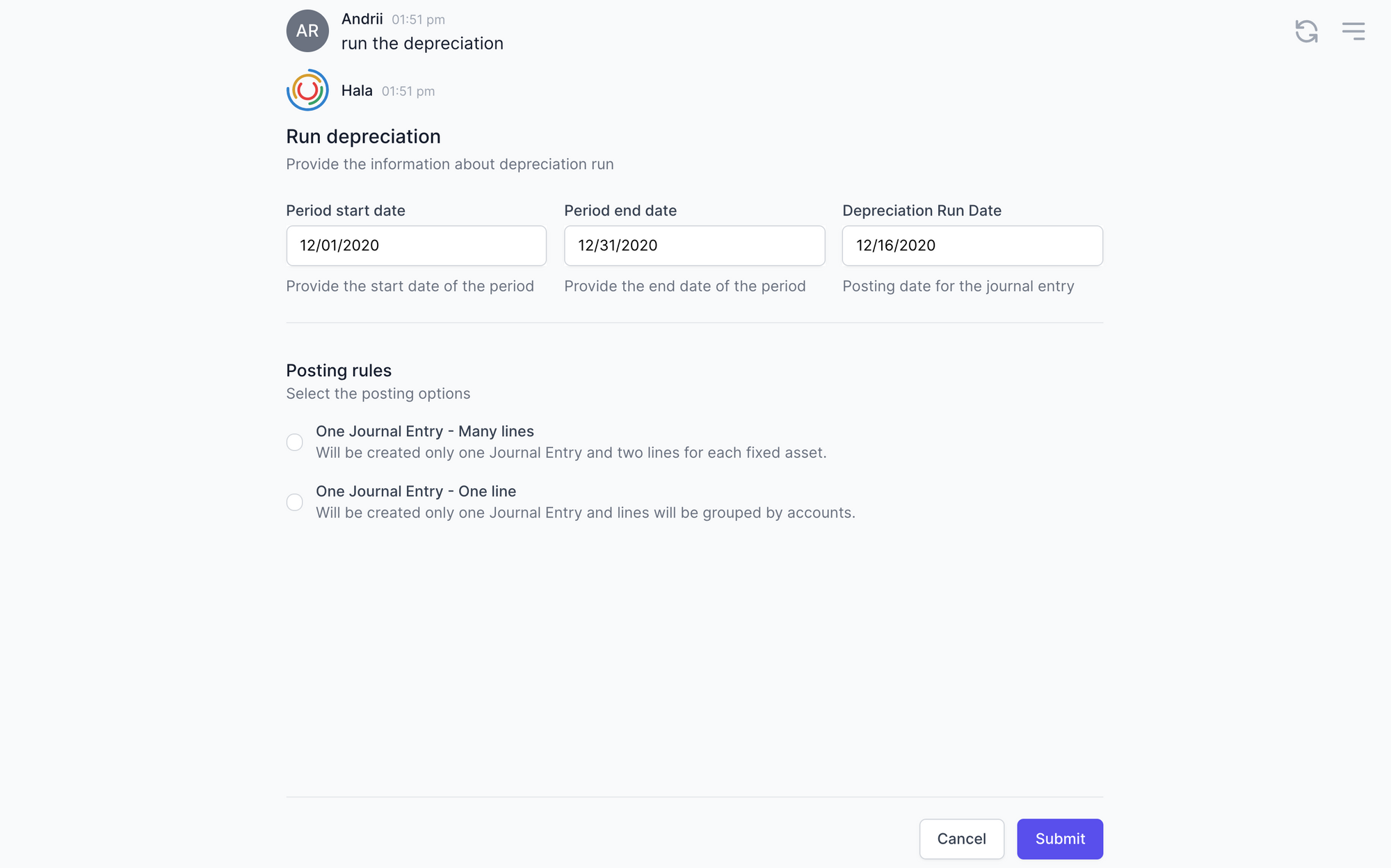

Data to enter

- Period start date - Start date of the period for which you want to run the depreciation;

- Period end date - End date of the period for which you want to run the depreciation;

- Depreciation Run Date - this is the posting date for the Journal Entry in QuickBooks Online.

- One Journal Entry (Many lines) - with that posting rule Hala will create only one Journal Entry and two fixed asset lines.

- One Journal Entry (One line) - with that posting rule Hala will create only one Journal Entry, and lines will be grouped by accounts.

How it wokrs

- Provide the dates and posting rules information on the first stage, then "Submit" the data;

- Hala will select all the assets for which the depreciation should be posted regarding the provided period. You will see the list of the assets, with depreciation amount and accounts. You would need to select the lines you want to post the depreciation and then "Submit" this.

- After that, Hala will send the information to QuickBooks Online to post the Journal Entry;

- When the document is posted, you will see the message that depreciation was posted successfully and information about the posted document in QuickBooks Online.

Default values

The Journal Entry in QuickBooks Online will include the next default values:

Memo - Depreciation post for the period from DD/MM/YYYY till DD/MM/YYYY

Description for each line - Depreciation "Name of the asset."

Posting in QuickBooks Online

This action will generate the one Jouranl Entry in QuickBooks Online.

Integration

This skill is by default available for the next enterprise software: